Credit Union vs. Bank – what is the difference?

When shopping around for a place to manage your money, you will probably look at credit unions and banks. What is exactly is the difference between a credit union and a bank? Probably a lot more than you thought and a lot less than you thought.

The biggest and most obvious difference is who owns it. According to Make Your Money Matter, the shareholders own the credit union:

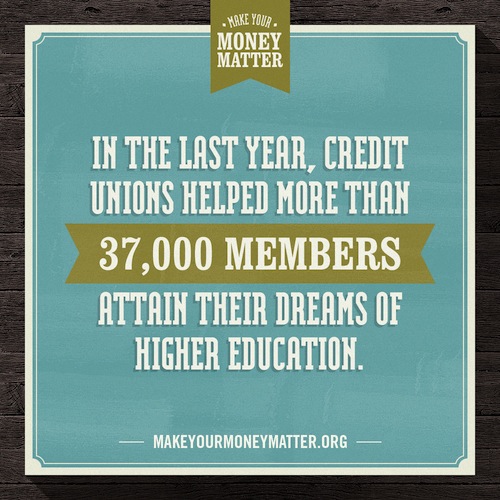

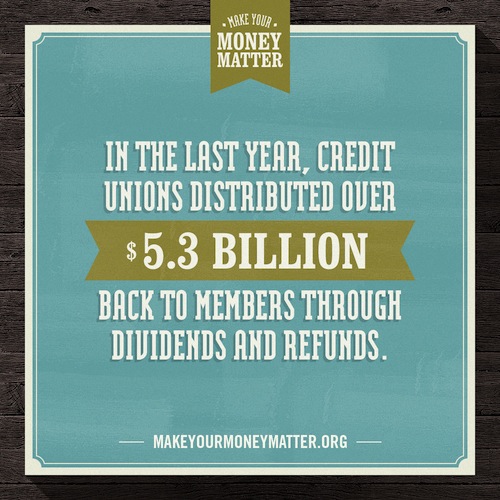

Credit unions are not-for-profit cooperatives that exist solely to provide financial services to their members, and anyone can find one that he or she is eligible to join. Unlike banks, it’s the members, not corporate shareholders, who own the credit unions. That means all the profit that credit unions bring in goes back to members in the form of dividends, rebates and lowered interest rates; for every $100 deposited at a credit union, on average $67 is directly redeployed to individual borrowers within the membership.

Both credit unions and banks offer similar services – checking accounts, savings accounts, loans – but the rates and fees will be vastly different. Since credit unions are owned by the shareholders, they are more likely to offer lower interest rates on loans and higher interest returns on investments, as well as lower fees for checking accounts, ATM surcharges, overdrafts and stopped payments.

Visit MakeYourMoneyMatter.org to learn more.

This post is sponsored by Make Your Money Matter, in association with PSCU, though all views expressed are my own.

Have you used a credit union? What was your experience?